The glass bottle enjoys a good image regionally or nationally due to the idea of reusability. The reusable rate for beer glass bottles was 57.6% in Austria in 2022.

Comparatively, the rate of reusable bottles for mineral water (16.7%) and soft drinks (6.4%) is relatively low. Reusable glass bottles can theoretically be refilled up to 50 times and continually shuttle back and forth between the bottler and the point of sale. However, due to wear and tear of the glass bottles, sometimes refill rates of only 5 to 10 times are achieved.

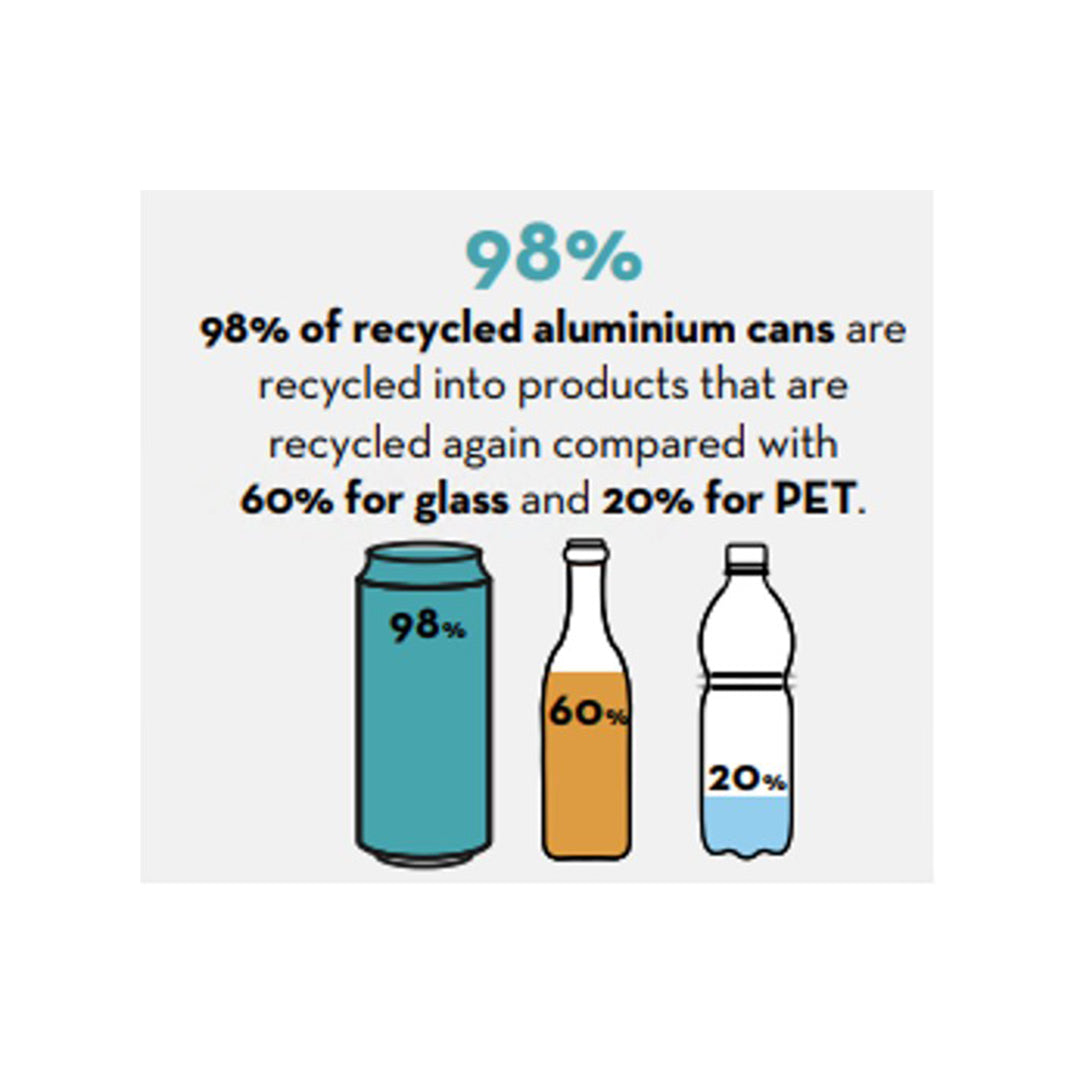

In addition to reusable glass bottles, single-use glass bottles are also in circulation - primarily in 0.33-liter quantities and mostly in high class restaurants. On average, glass packaging can be recycled back into the system by 60%.

However, compared to other beverage packaging, glass bottles have significant drawbacks: while the idea of reusability is understandable in terms of sustainability with glass bottles, the eternal transport of heavier glass bottles causes significantly higher overall greenhouse gas emissions. Thus, the further the bottle needs to be transported between the point of sale and the bottling location, the worse

its ecological balance.

Regionally, reusable glass bottles can be considered "sustainable" - but not for internationally operating companies that distribute their products globally.

Due to the high weight, on the one hand, transport and storage costs would skyrocket, and on the other hand, an even larger carbon footprint would be created.